Your revenue did not disappear overnight. It leaked out quietly.

No error alerts. No broken ads. No sudden drop that made everyone panic. Just a slow, steady drip that is easy to ignore when pages still load and dashboards still look fine.

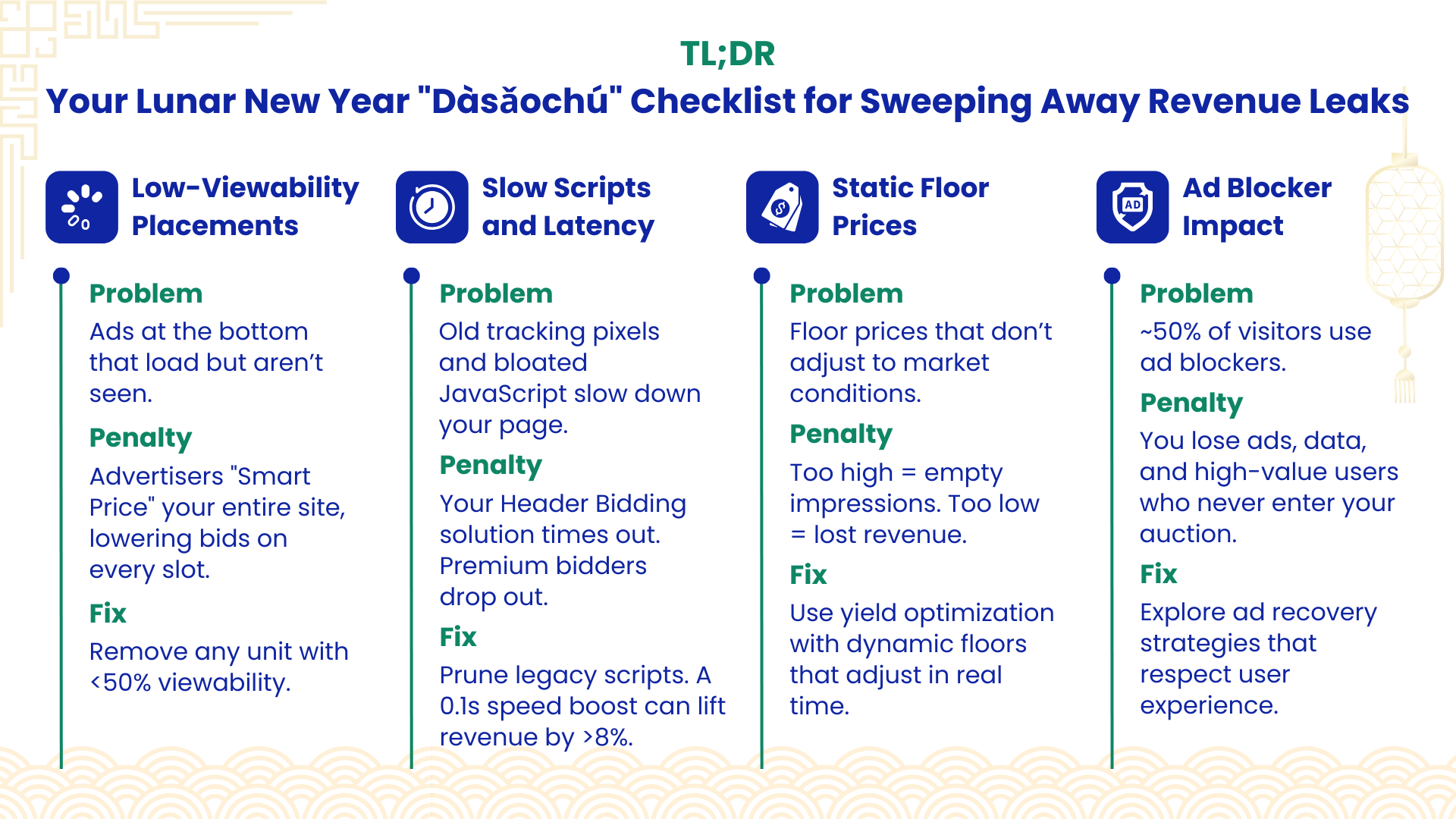

As the Lunar New Year approaches, the tradition of Dàsǎochú (大扫除; thorough cleaning) serves as a pragmatic framework for digital publishers to audit their inventory. This idea maps closely to yield optimization. Many yield issues do not come from obvious failures but from systems and decisions that quietly reduce monetization over time. This article examines common revenue drags that persist unnoticed and explains, with data, why they matter.

What does spring cleaning mean in a publisher monetization context?

In ad monetization, spring cleaning means finding technical, behavioral, and structural issues that reduce revenue without causing visible errors. These issues often stay in place because they are familiar, once worked well, or are easy to ignore.

Unlike outages or policy violations, these problems do not stop ads from serving. They reduce competition, weaken pricing, or limit access to demand. Publishers usually discover them during deeper reviews of latency, auction dynamics, or long running configuration decisions, not during everyday operations. This proactive approach is a cornerstone of effective publisher yield management.

How do ad blockers quietly reduce publisher revenue?

Ad blockers reduce monetizable impressions by stopping ads from rendering, bidding, or loading at all. This lowers auction volume, total impressions, and fill rate. Because blocked impressions never enter the ad stack, they are excluded from demand competition from the start.

eMarketer data shows that ad blocking is now common across most markets. 52% of consumers across 48 global markets have installed or used an ad blocker. In the United States, that number is 45%. For publishers, this is not a small loss at the margins. It is a permanent reduction in addressable inventory.

Ad blockers also make performance harder to read. Since blocked impressions never trigger auctions, CPM trends can look stable even while total revenue declines. This hides demand loss and delays corrective action. As a result, ad blocking often acts as a silent revenue drag rather than a clear technical problem.

What is the correlation between script latency and bid density?

The hidden cost of a slow site often appears in the timeout settings of header bidding solution wrappers. Every millisecond of latency caused by third party pixels or unoptimized JavaScript increases the Bidder Timeout rate.

For example, if a wrapper timeout is set to 1,000 milliseconds but the page takes 2,000 milliseconds to initialize the library, premium bidders may drop out of the auction. They do this to protect their own infrastructure and efficiency. Fewer bidders mean less competition and lower clearing prices.

A Deloitte Digital study showed that a 0.1 second improvement in mobile site speed increased retail conversion rates by 8.4 percent. For publishers, better speed leads to higher yields because more bidders are able to participate. Removing zombie scripts, such as unused tracking pixels or legacy social plugins, helps ensure the auction runs before the user scrolls away or exits the page.

Why do poor ad placements result in “Smart Pricing” penalties?

Placement efficiency is strongly tied to Viewability, which measures whether an ad is actually seen by a user. Problems arise when publishers keep ghost placements, such as units at the bottom of a page that load but are rarely reached.

Demand Side Platforms use historical performance data to apply Smart Pricing. If a placement consistently shows low viewability or weak outcomes, the DSP lowers its bids to protect advertiser budgets. Over time, this does not only affect the weak placement. It can reduce bids across the entire domain.

This creates a negative feedback loop where even high performing placements receive lower bids. Cleaning inventory means removing low value units so that every impression sent to the market has a strong chance of being seen and engaged with.

How do static floor prices create “Revenue Gaps” in the auction?

In a unified auction, a Floor Price is the minimum bid required to compete. Many publishers rely on static floors that remain unchanged for long periods. The problem is that programmatic demand changes constantly by time of day, day of week, and seasonal cycles like the Lunar New Year.

A static floor creates two types of revenue leakage:

- The Unfilled Gap: If your floor is set at $1.50 but the highest market bid is $1.45, the impression goes unsold (0% yield) despite a willing buyer being present.

- The Money on the Table: If your floor is too low ($0.10) and a buyer is willing to pay $2.00, in certain auction types, the lack of a competitive floor might lead to the impression clearing at a significantly lower price than the buyer’s true maximum value.

Spring cleaning floors means moving toward Dynamic Floor Pricing. This adjusts minimum prices based on real time bid density, helping publishers capture bidder surplus while avoiding unnecessary no fill.

What a revenue focused spring cleaning checklist typically includes

Effective monetization audits usually review ad blocking impact by device, placement level CPM dispersion, script load timing, bidder timeout rates, and historical floor performance. These reviews rely on actual data, not assumptions or legacy setups.

The goal is not to push short term CPM spikes. It is to restore healthy auction dynamics so demand can compete fairly and revenue can grow in a stable, sustainable way.